Suffolk’s schools operate under a primary banking arrangement through Lloyds Bank plc which is set up via the Suffolk County Council Treasury Management team.

The Schools Accountancy Team (SAT) is involved with a number of banking functions for and on behalf of Suffolk’s maintained schools supporting both statutory and non-statutory activities.

In the associated pages with in this section there will be brief summaries outlining some of those areas covered, as well as additional guidance, policy, compliance advice and relevant documents.

Where to send your change of signatories

Annual Reconciliation

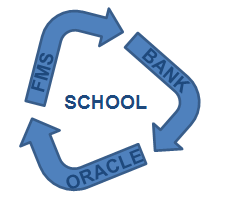

Each year SAT is required to perform a statutory multipoint reconciliation on behalf of each of Suffolk’s schools for external audit. This piece of work is referred to locally as the ‘3 Way Reconciliations’ based upon audit require all schools accounts to reconcile through three factors:

This process incorporates the reconciliation of nearly 300 school accounts and for the entire schools DSG funding, some £365m, and thereby is the largest banking function the team undertakes.

Periodic Bank Reconciliations

Each of Suffolk’s maintained schools are required to submit regular bank reconciliations. This is undertaken in school on their local finance system – FMS. Schools are required to submit their reconciliations for the months of; September, January and March, with the March return also forming part of the 3 way annual reconciliation process.

Schools are required to submit copies of their FMS reconciliation, bank statement and a copy of their remaining unreconciled items printed from their FMS system and by the 25th of the following month. This is outside of the year end reconciliation requirement.

Online Banking

We can now offer all SCC schools with the ability to view their Lloyds bank statements online via their new online banking platform called Commercial Banking Online or CBO. This will enable schools to provide more accurate forecasting to Governors, and allowing the timely completion of banking tasks. The previous online banking process was rolled out by Schools Choice but this process has now moved back into the Schools Accountancy team. Schools wishing to adopt a SAT generic policy for their school can do so by reviewing/amending the Generic Online Banking Policy.

Please complete our online banking request form and return it to [email protected].

Quarterly Interest

Another feature of the Lloyds banking offer for Suffolk’s schools holding a Lloyds account, is that SAT calculate a quarterly interest payment to make to schools. The Treasury Management team invests the central county fund by way of growing and thereby securing overall growth to the fund. The daily balances for each school gets mapped against the ‘Insight Rate’ issued by Treasury Management, with the interest paid to schools in July, October, January and April (Period 13).